Wealth ServicesPortfolio Management

The best aspects of passive and active investing applied to your portfolio

Our portfolio management process combines decades of investing experience with time-tested & cutting-edge academic research.

Passive, Low-Cost Investments

ACM invests using passive, low-cost, tax-efficient ETFs and mutual funds. We utilize funds that seek to isolate and emphasize specific risk factors that are the primary drivers of returns in each asset class. We believe this “second derivative” index fund approach allows for optimal diversification and better risk-adjusted returns, while still keeping investment expenses to a minimum.

Active Portfolio Management

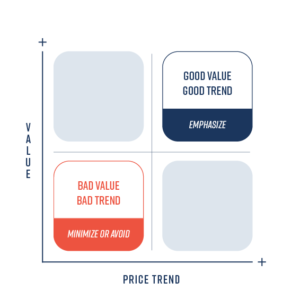

ACM’s active portfolio management includes dynamically allocating capital across asset classes and their underlying academic risk factors. The ACM tactical approach is driven by our proprietary combination of relative valuation and price trends. While the benefits of value investing and trend-following have been separately validated by decades of financial research, more recent studies demonstrate a symbiotic relationship. Simply put and illustrated below, we emphasize investments with attractive valuations and rising prices, while conversely minimizing exposure to investments with high valuations and falling prices.

Risk Management

ACM manages diversified portfolios across the risk spectrum. These offerings are managed, first and foremost, with the objective of limiting downside risk to defined levels. It is only within those risk constraints that we seek to maximize returns. The inclusion of price trend analysis in our investment methodology ensures that underperforming investments are systematically minimized in an effort to avoid major losses.

Tax-Efficiency

In managing taxable accounts, we seek to optimize “after-tax” returns. In addition to utilizing tax-efficient ETFs and mutual funds, ACM carefully monitors the realization of taxable investment gains. We further seek to enhance tax-efficiency with a disciplined, year-round tax loss harvesting program,

Custody

Schwab Advisor Services, a division of Charles Schwab & Co., has provided our clients with custodial and brokerage services for more than twenty years. Schwab Advisor Services combines low transaction fees with superior customer service and technology. They are committed to providing our clients with the highest level of privacy, online security, and asset protection.