ACM identifies emerging markets as the most undervalued segment of the global equity markets. Launches Enhanced Emerging Markets Strategy using a proprietary, country-specific methodology with a prudent use of leverage. Read More About ACM Alternatives >> Read Beginning Timeline Item>>

Archives

ACM Navigates 2015-2016 Market Volatility

“In our portfolios, we have moved into a defensive position, with equity allocations about 10% below policy targets. The recent backup in interest rates has made bonds a bit more compelling versus equity markets that are showing some early signs of technical weakness. We believe that a modest correction is most likely and we would be buyers of stocks at lower prices...

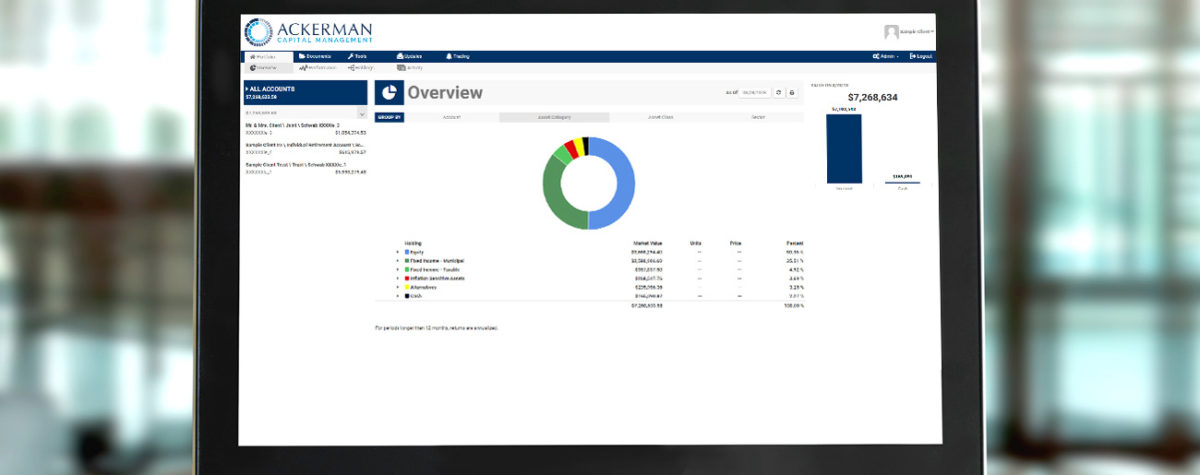

ACM Launches New Client Portal

In partnership with Orion Advisor Services, ACM launches its new client portfolio management portal. Utilizing the latest financial technology advancements, ACMs provides its clients with real-time portfolio performance and analytics on all investment accounts, whether managed by ACM or not, giving them the ability to have a fully comprehensive view of their investments in one accessible location. Read More Client Tools >>...

ACM Offers Fiduciary Retirement Plan Services to 401(k), 403(b), cash balance plans

Ackerman Capital has a long history of emphasizing value, performance and client service and our 401k team continues that excellence. Our primary goal is to maximize the retirement benefit that a client can provide for themselves and their employees – ensuring their firm has the resources and tools that they need in order to save for a comfortable retirement. Read More Retirement Plan...

ACM Begins Managing Corporate Trust Accounts

Through directed trust provisions, ACM begins providing investment management services to individual and family trusts that are administered by a corporate trustee. The directed trust provision bifurcates trust administration and investment management services, enabling a trust owner to “direct” the bank to use a preferred investment management service like ACM. Bank of Texas embraces this flexible provision to provide additional benefits to a trust...

ACM Navigates Volatile 2011 Stock & Bond Markets

“Generally speaking, the equity allocation in our portfolios are at or near the low end of investment policy ranges, and, conversely, our fixed income allocation are at or near the high end of their allocation ranges. In both asset classes out primary focus is “quality.”…We are avoiding exposure to commodities, commodity-oriented stocks, emerging market stocks and bonds…Today these investments are far too...

ACM Pinpoints 2009 Bear Market Lows

“We added significant equity exposure at or near the exact market lows in March that preceded the current market rally. In most cases the amount of equity exposure added ranged from 10% to 15% and was concentrated in depressed value funds. Looking back many years from now, it will be clear that this period represented a good opportunity to buy stocks at...

ACM Predicts 2007-2008 Housing Collapse, Financial Crisis, & Recession

“While many economists and Wall Street strategists are predicting a “soft landing” for the economy, we are less optimistic. We have long believed that the housing boom was being driven to a much larger extent by aggressive lending practices than underlying fundamentals, and as a result, we believe that we are entering a housing slump that will be deeper and longer than...